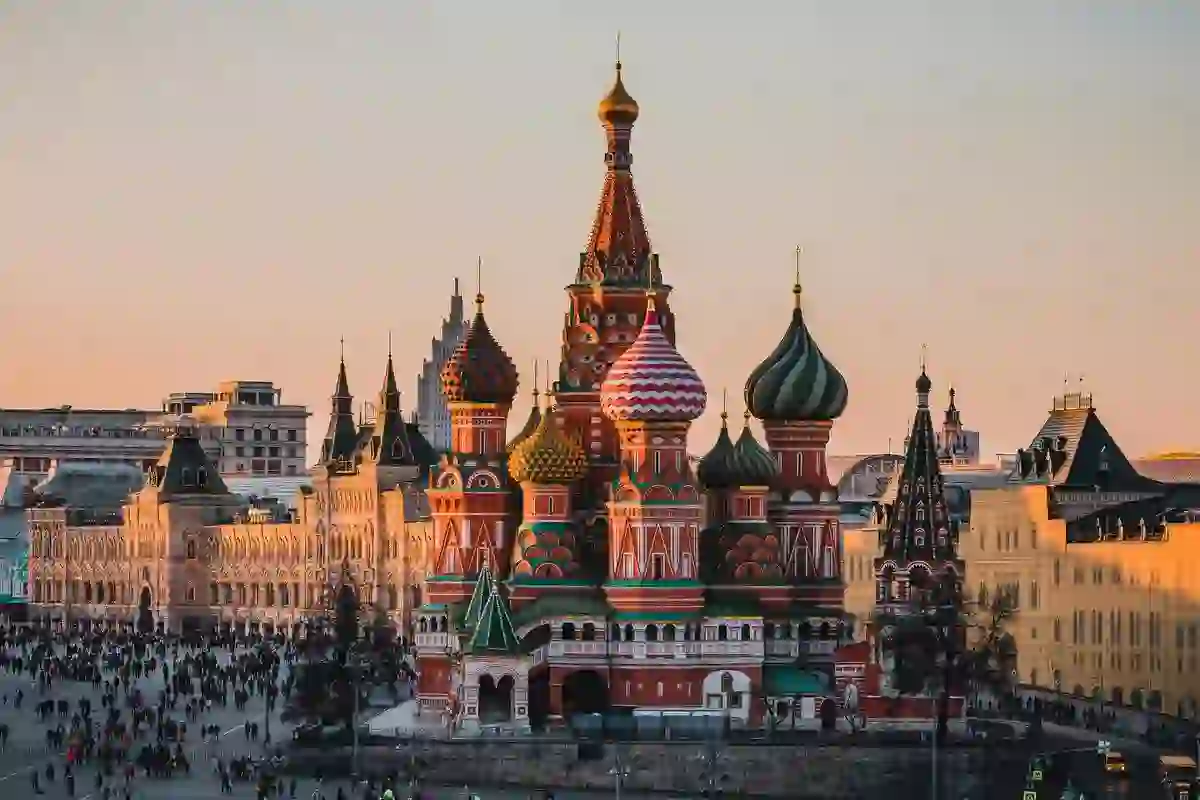

VanEck’s Decision to Discontinue ETF for Russia Following U.S. Investment Freeze in Moscow

- Shams ul Zoha

- December 29, 2022

- 1:00 pm

WHAT YOU SHOULD KNOW

- VanEck has decided to close its exchange-traded funds that focus on Russia due to the ongoing conflict in Europe.

- Sanctions prevent large companies such as Gazprom from being traded in Western markets, leading to liquidity issues for investors.

VanEck has decided to close its vaneck russia etf due to the ongoing conflict in Europe, which has made it impossible for Western investors to access the Russian market.

ETFs related to Russia experienced a sharp decline following the Russian military’s incursion into Ukraine.

The Moscow stock exchange was forced to close for a period of time, and the sanctions that remain in place prevent large companies such as Gazprom from being traded in Western markets, leading to liquidity issues for investors.

VanEck’s Russia ETFs, the VanEck Russia ETF (RSX) and the VanEck Russia Small-Cap ETF (RSXJ), have been unable to trade/frozen since March 4.

VanEck stated in a Wednesday night announcement that the Funds will only participate in activities related to winding up their affairs and not any other business or investment activities. The Funds have been unable to purchase, sell, receive or deliver Russian securities, making it impossible to manage them in a way that is consistent with their intended investment goals.

The company has halted the withdrawal of funds, as mandated by the Securities and Exchange Commission, while it sells off its investments.

VanEck announced that it intends to distribute the proceeds from the liquidation to investors around the beginning of January.

At the start of 2022, the RSX fund had an estimated $1.3 billion in assets under its management, as reported by FactSet.

Investing Salary provides free access to quality, truthful news for everyone, believing that information should be equally accessible. We hope that this will enable more people to stay informed about current events, understand their effects, and be motivated to take action.

If you feel that we have helped you get the right market knowledge please consider supporting us through Patreon. Even a single dollar counts.

Related news

Popular